Snapshot for the FBT year ending 31 March 2024

FBT rate: 47%

Type 1 gross-up rate: 2.0802

Type 2 gross-up rate: 1.8868

Benchmark interest rate: 7.77%

Car parking threshold: $10.40 daily

Record-keeping exemption: $9,786

Timing: FBT return is due by 21 May 2024, or by 25 June 2024 if lodged electronically through your tax agent.

Why does FBT exist?

Fringe Benefits Tax is a tax levied on employers for certain non-cash benefits provided to employees, assiciates and related parties. FBT exists to prevent tax leakage from businesses deducting the cost of providing those benefits but income tax is not collected on the employee side.

Main types of fringe benefits

- Cars

- Car parking

- Meal entertainment

- Loans

- Housing

- Living away from home allowance (LAFHA)

- General property or residual

Concessional treatment for NFPs

For purpose organisations can struggle to compete against for-profit businesses for good-quality people. Accordingly, the concessional FBT treatment afforded for purpose organisations help them attract and retain staff by enabling them to provide some benefits without an FBT impost or a reduced one. This means they can provide comparatively more benefits to staff and/or offer more attractive salary-packaging options.

NFP employer categories

There are two categories of for purpose (NFP) organisations that enjoy concessional FBT treatment:

- FBT-exempt employers

- FBT-rebatable employers

FBT-exempt employers include hospitals, public ambulance services, public benevolent institutions (PBI) and health promotion charities. They can provide fringe benefits without incurring an FBT liability (up to a cap).

FBT-rebatable employers include non-government, non-profit organisations. Fringe benefits they provide initially incur the normal amount of FBT liability, which is then reduced by a 47% rebate (up to a cap).

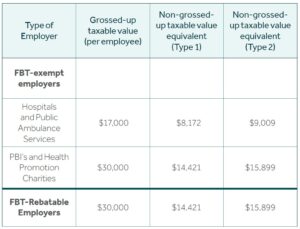

Capping thresholds for the 2024 FBT year

The below employers can provide fringe benefits that are respectively exempt or eligible for a rebate, up to the following caps per individual employee:

The above concessional treatment is available for any kind of fringe benefit provided. They do not have to be provided as part of a formal salary-packaging arrangement, but often are a part of attracting good-quality employees.

For example:

- A PBI could pay $15,899 worth of an employee’s home mortgage repayments (Type 2 benefit) under a salary-sacrifice arrangement, and incur no FBT. For the employee, the effect of this is the same as getting a tax deduction for those mortgage repayments.

- A rebatable school could provide a $70,000 petrol car to an employee (Type 1 benefit), which is used 100% for private use, and, after the rebate, incur annual FBT of about $7,200. This is around half of what a business employer would pay. Accordingly, the school can offer the car as a more attractive salary-packaging option. An employee contribution to reduce the FBT impost or an electric vehicle can produce an ever better outcome for both parties.

Full FBT will apply to any excess above the relevant cap provided to an individual employee. Please note that car parking benefits or employer-provided entertainment are subject to their own caps. Salary-packaged entertainment is reportable on the employee’s Payment Summary. It is important to be aware that the rebate is not apportionable, therefore if an employee begins with the employer on 1 January 2024 they are entitled to the full rebate.

However, if an employee doesn’t use their full cap, they are unable to carry it forward any balance, and the employer cannot apply the excess cap to other employees.

Salary-packaged meal entertainment

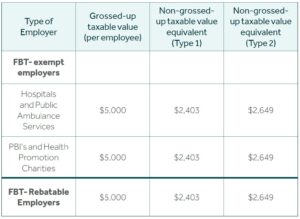

NFP employers can also provide exempt salary-packaged meal entertainment and entertainment facility leasing benefits up to the following caps:

Full FBT will apply to any excess above the cap provided to an individual employee. Note that this exemption applies only where the benefits form part of a salary-packaging arrangement, but the above caps are in addition to the further above capping thresholds for fringe benefits generally.

Examples of salary packaged meal entertainment include:

- Venue hire when you have exclusive use of premises, excludes members of the general public entering (separate room / distinct area of a larger space)

- Holiday accommodation i.e hotels (no travel costs)

Meals (café, restaurant, hotel) that are for 2 or more people

Important to note that it doesn’t include take away food, groceries or travel costs to accommodation.

Religious-denominated schools

A private school registered as a religious institution employing a religious practitioner principally for pastoral duties and/or teaching religion can provide an unlimited quantity of fringe benefits to that employee that are fully exempt from FBT.

Car parking

Registered charities, scientific institutions and public educational institutions are exempt from FBT when providing car parking fringe benefits.

Some general exemptions from FBT

In addition to the above concessions for NFPs, these fringe benefits are exempt for all employers generally:

Portable electronic device, where primarily used for employment. One per year, per employee. Eg, Laptop, tablet, Surface Pro, mobile phone unless it is a replacement item.

Minor benefits, where infrequent and irregular benefits provided are less than $300 GST inclusive (excluding meal entertainment for income tax-exempt organisations).

Otherwise deductible expenses, where the employee would normally be able to claim an income tax deduction for the benefit provided.

Electric Vehicles, be aware of all conditions requiring to be met. From 1 April 2025, plugin hybrid vehicles will not be considered to be FBT exempt unless there is a financial binding commitment to continue providing private use after 1 April 2025.

Reportable fringe benefits

Where the taxable value is greater than $2,000, the grossed-up amount of certain fringe benefits is reported on an employee’s PAYG payment summary. The minimum grossed-up value is $3,773 (being $2,000 multiplied by the Type 2 gross-up rate). Although the employee does not pay income tax on that amount, it factors into calculating various means-tested benefits such as;

- Liability to the Medicare levy surcharge

- Child support payments and benefits

- Recovery of HELP debt (previously known as HECS)

- Income tests for youth allowance, family tax benefit and childcare benefit

- Personal and spouse’s super contribution rebate

Where the benefits provided by a NFP to an employee are below the various exemption thresholds above, they do not have to be reported.

Think about the possibilities in your organisation

As you work through your 2024 FBT compliance, think about the possibilities in your organisation for next year. Talk to your trusted Nexia advisor about how we can help you better manage the provision of benefits, and get the best outcomes for you and your employees.